Scammers have stolen around $375,000 intended to fund the aged care costs of 102-year-old Nancy Pun.

The woman’s grand-daughter, who has enduring power of attorney, was organising the transfer of the funds from Nancy's Ferndale home sale to the aged care home through a settlement agent.

The scammers intercepted email communications between the grand-daughter and the aged care facility and sent a bogus email purporting to be the nursing home advising of a change of bank account details for the transfer.

The grand-daughter sent these bank account details along with instructions to the settlement agent.

When settlement on the Ferndale property went through, the proceeds of $374,251 were transferred to the scammers’ bank account in Sydney.

The grand-daughter also sent a top-up payment of $749 which was later retrieved, but so far not the larger amount.

In 2020, 39 people reported total losses of about $753,000 to payment redirection scams in WA.

So far this year, 16 victims have already lost $450,000.

Commissioner for Consumer Protection Lanie Chopping is concerned at the increasing cases of redirection scams, many of which are targeting large property transactions.

“These scams involve the hacking into someone’s email account or computer system but it can be difficult to determine exactly where the hack has occurred,” she said.

“The hackers may have successfully guessed the password or installed spyware or malware on computers or laptops after recipients open attachments or click on links in scam emails.

“Choosing a difficult to guess password and changing them often can reduce the risk of being hacked, and not opening attachments or links in suspicious emails is essential in keeping computers secured. Businesses should train their staff to be scam aware.

“We suspect another exposure may be the use of unsecured WiFi connections either at home or in public places which may provide scammers with a window of opportunity to break in.

“Businesses need to regularly review their cyber security as well as office practices and procedures to minimise the risk of them or their clients being susceptible to hacking scams and any attempts are detected quickly before transfers are made and money is lost.”

Stolen Ford Mustang linked to southern suburbs incidents

Stolen Ford Mustang linked to southern suburbs incidents

Baldivis: Truck fire forces closure of Kwinana Freeway

Baldivis: Truck fire forces closure of Kwinana Freeway

Concerns for missing Baldivis girl

Concerns for missing Baldivis girl

MARC leisure pool, pirate playground to close for several weeks due to maintenance works

MARC leisure pool, pirate playground to close for several weeks due to maintenance works

Petition launched to change new Eastern Foreshore playground due to safety concerns

Petition launched to change new Eastern Foreshore playground due to safety concerns

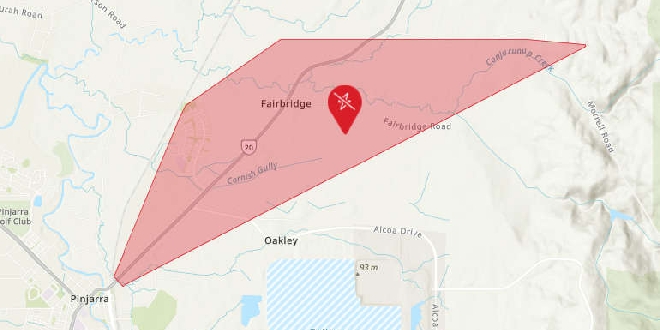

Parts of Pinjarra, Fairbridge without power

Parts of Pinjarra, Fairbridge without power

Bouvard scrub fire deemed suspicious

Bouvard scrub fire deemed suspicious

Peel Thunder crush Perth in WAFLW season opener

Peel Thunder crush Perth in WAFLW season opener

Baldivis man charged after AFP seize haul of cigarettes, vapes, $2.6M cash

Baldivis man charged after AFP seize haul of cigarettes, vapes, $2.6M cash