Three one-hour sessions will be held in Mandurah on Tuesday to educate business owners on keeping honest business and record keeping in a bid to level the playing field by tackling the ‘cash and hidden economy’.

Tomorrow employees from the Australian Taxation Office will be in Mandurah talking to local small businesses as part of an effort to ensure that they have the support and information to get their tax and super right.

Part of the sessions will focus on tackling the problem of the cash and hidden economy, where group's deliberately hide income to avoid paying the right amount of tax or superannuation.

The Australian Bureau of Statistics estimates the cash and hidden economy accounts for about $21 billion that could be used for schools, roads and hospitals.

Assistant Commissioner, Matthew Bambrick said that everyone in business should be given a fair go.

"Businesses that don’t pay the correct amount of tax are not giving other business a fair go and are not making their contribution to the community," he said.

"Businesses that don’t do the right thing by their employees, like underpaying them or not paying their super, are not giving others a fair go."

Mr Bambrick said that now that most small businesses offer electronic payments, only accepting cash raises a red flag because it provides the opportunity to not accurately report all their income.

“We encourage businesses that take cash payments to invest in an electronic payment facility to make payments quicker and easier and help them to track their business activities and keep accurate records," he said.

“These days, most Australians expect to be able to pay electronically, so it’s also in business' best interest to provide electronic payment options, like card and mobile payments.”

“ATO staff have been visiting businesses across the country to help them make sure their cash adds up. We’re focusing on industries that typically have high cash transactions or only take cash, like restaurants, cafes, pubs, hairdressers, beauty salons.”

The other focus of information sessions will be record keeping, Mr Bambrick said recent visits to businesses showed improvement in record keeping was necessary.

"Our staff have seen cash from sales being put in boxes, or straight into wallets, and open cash register drawers. Some businesses just guess their income because, they tell us, they don’t keep good records. That’s not fair for the majority of business, who do the right thing," he said.

“We understand that businesses are busy and some just need a bit of help. If we find a business that needs help, we’ll support them while they get back on track.

"If we’re concerned that a business is deliberately doing the wrong thing we will investigate further.”

In the first six months of 2017-2018, the ATO has raised $143 million tax and penalties from its cash and hidden economy compliance activities.

The ATO has implemented a range of measures to prevent, detect and deter tax evasion including data matching, small business benchmarking, reviews and audits.

Businesses are invited to attend a one-hour information session at Peel Thunder Football Club at either 9-10am or 6-7pm and a record keeping information session 10.15-11.15am.

This visit is part of a broader program by the ATO to ensure fairness for honest businesses and to level the playing field by tackling the ‘cash and hidden economy’.

Stolen Ford Mustang linked to southern suburbs incidents

Stolen Ford Mustang linked to southern suburbs incidents

Baldivis: Truck fire forces closure of Kwinana Freeway

Baldivis: Truck fire forces closure of Kwinana Freeway

Concerns for missing Baldivis girl

Concerns for missing Baldivis girl

MARC leisure pool, pirate playground to close for several weeks due to maintenance works

MARC leisure pool, pirate playground to close for several weeks due to maintenance works

Petition launched to change new Eastern Foreshore playground due to safety concerns

Petition launched to change new Eastern Foreshore playground due to safety concerns

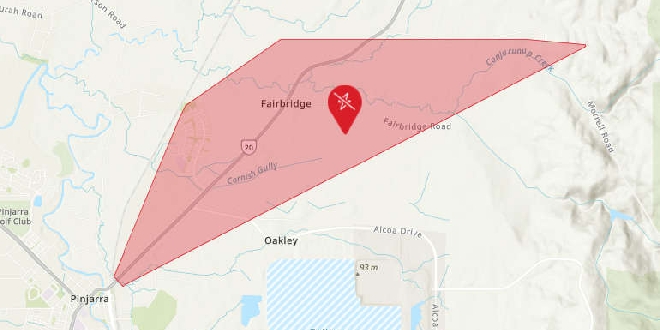

Parts of Pinjarra, Fairbridge without power

Parts of Pinjarra, Fairbridge without power

Bouvard scrub fire deemed suspicious

Bouvard scrub fire deemed suspicious

Peel Thunder crush Perth in WAFLW season opener

Peel Thunder crush Perth in WAFLW season opener

Baldivis man charged after AFP seize haul of cigarettes, vapes, $2.6M cash

Baldivis man charged after AFP seize haul of cigarettes, vapes, $2.6M cash